Our clients have been asking about the housing market and wonder what to expect in 2024. Here’s what the experts are telling us:

Where Are Home Prices Headed?

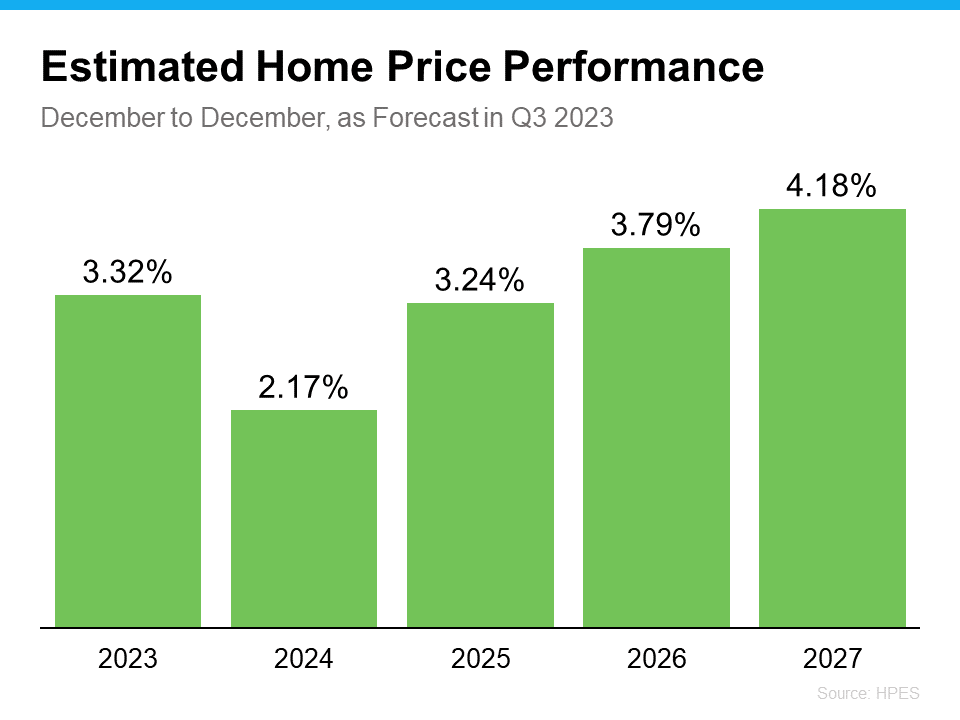

While there’s been a lot of concern prices would come crashing down this year, data shows that didn’t actually happen. In fact, home prices are rising in most of the nation. Experts say that trend will continue, just at a slower pace that’s much more normal for the market – and that’s a good thing.To help show just how confident experts are in this continued appreciation, here’s the Home Price Expectation Survey from Pulsenomics. This is a survey of a national panel of over 100 economists, real estate experts, and investment and market strategists. As the graph below shows, the consensus is, prices will keep climbing next year and in the years to come.

But that’s not the only question on everyone’s minds. Next up: Mortgage Rates.

What’s Next for Mortgage Rates?

More than anything else lately, the housing market has been defined by rapidly rising mortgage rates. And they haven’t just risen. They’ve more than doubled since they days of under 3% we remember not long ago.

Rates definitely impact how much buyers can afford. And while no one can say for certain, here’s what we know based on recent data and historical trends.

There’s a long-standing relationship between mortgage rates and inflation. Basically, when inflation is high, mortgage rates tend to follow suit. Over the past year, inflation was up, so mortgage rates were as well. But inflation is easing now. And this is why the Federal Reserve has recently paused their federal funds rate hikes, which means many experts believe mortgage rates will begin to come down.

We’ve started to see hints of slightly lower mortgage rates in recent weeks. But it’s certainly been volatile, and will likely continue to be that way going into the year. Some ongoing variation is to be expected, but the anticipation is, in 2024, we’ll see a downward trend.

As Aziz Sunderji, Strategist at Home Economics, says:

“The bottom line is that interest rates are likely to be lower-perhaps even lower than many optimists think – in the weeks and months to come.”

So the answer to mortgage rates is to just keep an eye on inflation. Then there’s the other piece of this – the dreaded “r” word: Recession.

Is a Recession Around the Corner?

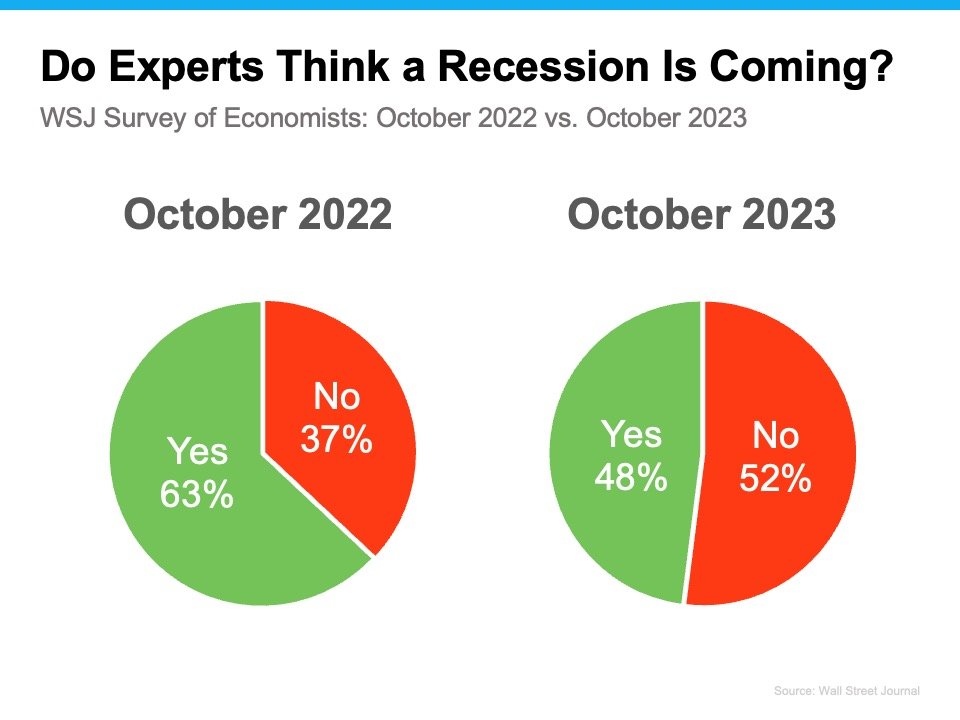

While recession talk has been a common thing over the past few years, there’s good news on that front.

The Wall Street Journal (WSJ) polls experts on this topic regularly. And last year at this time, most of them thought a recession would have happened by now. But as experts look at all the leading indicators today, they’re changing their minds and saying a recession is getting less and less likely. The latest results show that more experts now think we’re not headed for another recession (see chart below):

This is big news for the housing market. And while the 48% to 52% split may seem close to half and half, the key thing to focus on is the majority of these experts think we’ve avoided a recession already.

Ultimately, all of these questions lead to this one: Should I buy a home this year?

Should I Buy A Home This Year?

So, is it a good time to buy a home right now? The answer is different for each client we work with.

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt. These decisions can be hugely consequential for consumers and businesses.” – Jason Lewis, Co-founder & Chief Data Officer, Parcl

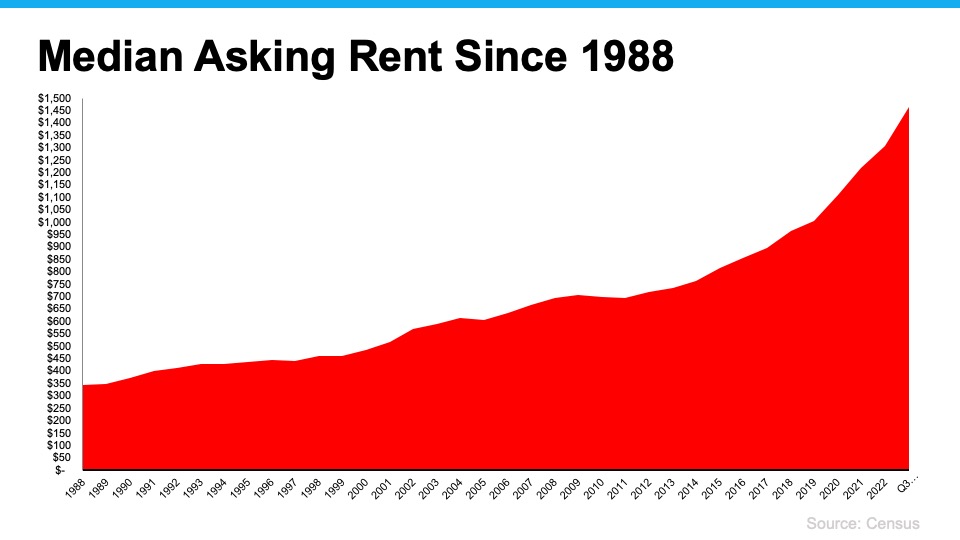

For first-time homebuyers, the biggest factor to consider is rising rental costs throughout the country. The slide below truly tells the whole story. The reality is, homeownership presents the opportunity for a stable monthly payment as well as the ability to build wealth and make a long-term financial investment. It offers security and a sense of accomplishment that renting can’t.

The next piece is that life happens. Personal situations change, jobs require relocation, aging parents may have to move, etc. These can all play a big part in someone’s need to buy or sell a home right now.

At the end of the day, while the market may be in a different place than it was over the last few years, there are many financial and non-financial benefits of homeownership that stand the test of time.

“If you can find a house that meets your financial expectations for a monthly payment and it is a good time for you to buy, then do that…And if you wait for prices to fall and they never do, you may discover the hard way that the house you found a year ago that you really loved, that you could afford but you passed on, is more expensive next year.” – Odeta Kushi, Deputy Chief Economist, First American

Bottom Line

Let’s connect and discuss the bigger picture of what’s ahead for housing and how it may relate to you.