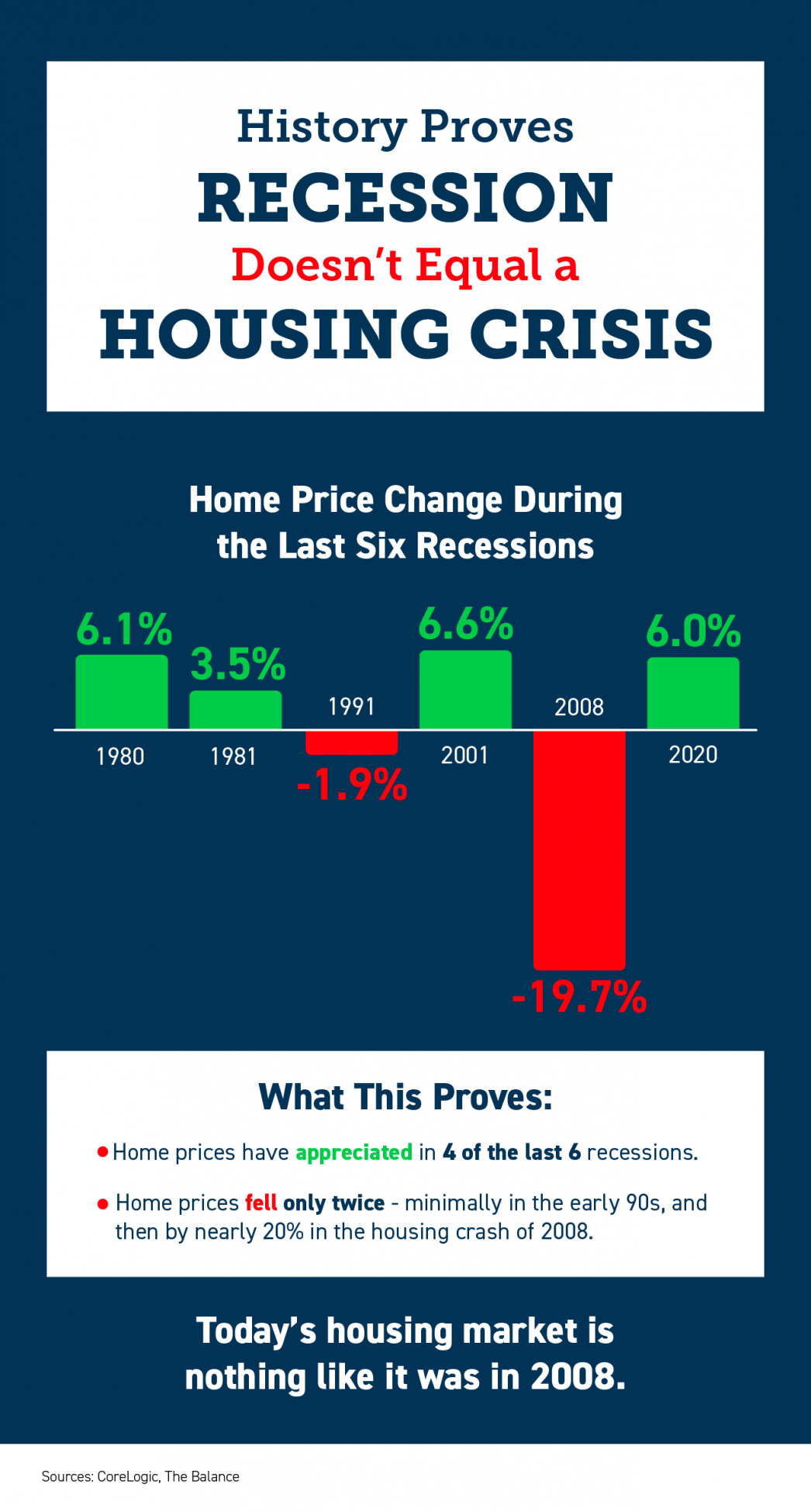

If we look at history, an economic slowdown does not necessarily equal a housing crisis.

In fact, 4 of the last 6 recessions, home prices actually appreciated. Home prices only fell twice – minimally in the early 90s and then nearly 20% during 2008’s housing crash.

The other big takeaway if a recession happens: interest rates usually go up at the beginning of an economic decline, but in order to stimulate the economy, they will typically fall.

According to Fortune,

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

So, while the days of mortgage rates below 3% may be over, we also can’t say for sure they’re only going to go up from here.